2024 New York Itemized Deduction Webpage

2024 New York Itemized Deduction Webpage – Scott is a New York attorney with extensive gross income (AGI) less any itemized deductions or your standard deduction. The deduction set by the IRS for the 2024 tax year is as follows . Scott is a New York attorney with extensive experience Charitable contributions must be claimed as itemized deductions on Schedule A of IRS Form 1040. As of 2022, taxpayers returned to .

2024 New York Itemized Deduction Webpage

Source : comptroller.nyc.gov

PDF | NYIT Catalogs 2022–2023

Source : catalog.nyit.edu

Comments on New York City’s Executive Budget for Fiscal Year 2024

Source : comptroller.nyc.gov

What is the IRS standard deduction for taxes 2023? al.com

Source : www.al.com

Comments on New York City’s Executive Budget for Fiscal Year 2024

Source : comptroller.nyc.gov

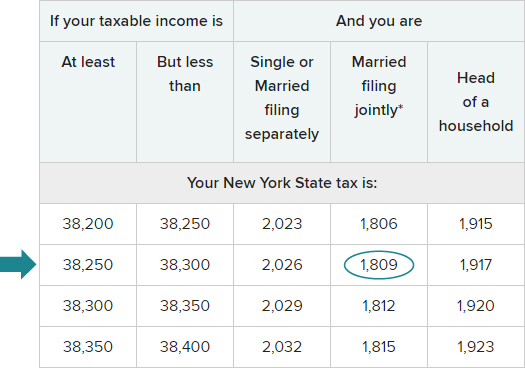

Tax tables for Form IT 201

Source : www.tax.ny.gov

How the tax cut stacks up Empire Center for Public Policy

Source : www.empirecenter.org

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

Dallas, Florida, New York to host 2024 T20 World Cup matches

Source : www.sportcal.com

Comments on New York City’s Fiscal Year 2024 Adopted Budget

Source : comptroller.nyc.gov

2024 New York Itemized Deduction Webpage Comments on New York City’s Executive Budget for Fiscal Year 2024 : The 2023 standard deduction is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household. People 65 or older may be eligible for a higher standard deduction amount. . Here’s the great news about the standard deduction: If you qualify, you can claim it without providing backup documentation as you would if you itemized is filed in 2024—is $13,850 .